Summary

Last week, I wrote about why I believe there will be no rate cuts in 2024. On Wednesday, the FOMC met and came out unexpectedly dovish. The dot plot continued to show a median of three cuts expected for 2024, the Fed seemed unworried about a recent acceleration in inflation, and Powell discussed slowing the rate of QT. Today, I attempt to understand their reasoning and determine if they are right in their analysis.

I first summarize the FOMC meeting and critique parts of it. I then write about how I use the Fed meeting to predict the path of rates before developing my view on the FOMC meeting. Lastly, I talk about how I think market narratives will develop over the coming quarters and I provide ways to play this view.

Despite what Substack says, this should be a ~10-minute read. The last five minutes of reading are just a recap of my time in London!

Contradictory FOMC Meeting

FOMC Summary

The Dot Plot

Coming into the meeting, the market was focused on the Fed’s “dot plot”, the visualization of each Fed official’s projection for the path of the Fed Funds Rate. The last dot plot was in December and since then, we have seen a significant re-acceleration in inflation. However, the dot plot seemed to mostly ignore the recent data with three cuts priced in for 2024 (Figure 1). Under the hood, the average did move closer to 2 cuts and some participants moved their rate projections upwards: just not enough to change the median.

Figure 1: December 2023 Fed Dot Plot

Estimates for GDP, Unemployment, and Inflation

Fed estimates for end-of-year GDP growth and inflation were higher than they were in December while estimates for the unemployment rate fell (Figure 2). This is rather confusing—the estimates for interest rates are still low, but the Fed believes the economy is strengthening. Usually, stronger data would lead to higher rates (I comment on this later).

Figure 2: Despite Dovish FOMC Meeting, Economic Projections Have Risen

Press Conference

I have included some notable quotes from Chairman Powell below (emphasis mine).

We’re strongly committed to bringing inflation down to 2% over time. That is our goal and we will achieve that goal. Markets believe we will achieve that goal and they should believe that because that’s what will happen over time. But we stress over time, and so I think we’re making projections that do show that happening and we’re committed to that outcome and we will bring it about.

If you were confused by the higher projections for higher growth and inflation but low unemployment and rates, the quote above should provide some clarity. By saying “over time”, Powell has subtly raised the inflation target. With inflation above target and unemployment very low, the Fed should be committed to bringing inflation down now and should not be dismissive about the recent re-acceleration in inflation. A slower movement to target is a form of abandoning the target as more purchasing power gets eroded (Figure 3).

Figure 3: A Slower Fall to Target = Weak Form of Abandoning Target

But I take the [January and February inflation prints] together and I think they haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road toward 2%. I don’t think that story has changed. I also don’t think that those readings added to anyone’s confidence that we’re moving closer to that point.

Most people’s view that we will achieve that confidence and that there will be rate cuts. But that’s really going to depend on the incoming data. The other thing is, in the second half of the year you have some pretty low readings. So it might be harder to make progress as you move that 12-month window forward.

In my view, Powell is being too dismissive of the recent uptick in inflation. Powell acknowledges that base effects will likely continue to lead to an acceleration in inflation, however, he still believes there will still be rate cuts. This is dangerous, shows the market the Fed really wants to cut, and hurts Fed credibility.

But ultimately, we do think that financial conditions are weighing on economic activity. And we think you see that.

Come on! Financial conditions are looser than when the rate hikes started (Figure 4), credit spreads are extremely tight (Figure 5), liquidity proxies like Bitcoin have rocketed upwards (Figure 6), and Jeo Boden coin is up 1300% over the last ten days.

Figure 4: Financial Conditions are Extremely Loose

Figure 5: Corporate Bond Spreads are Tight

Figure 6: Bitcoin, a Liquidity Proxy, has Skyrocketed

There was an uptick in the longer-run rate, and also there’s a 25-basis-point increase in ’25 and ’26…

I mean, my instinct would be that rates will not go back down to the very low levels that we saw where all around the world there were long-run rates that were at or below zero in some cases. I don’t see rates going back down to that level. But I think there’s tremendous uncertainty around that.

Powell acknowledges here that the neutral rate is likely higher, but dismisses certainty around it. The narrative is slowly shifting in favor of a neutral rate above .5% and in my view, the true neutral rate is likely above 1%.

Summarizing the Meeting

The dot plot shows the Fed wants to cut despite worsening data

The predictions for inflation and growth are high

The prediction for unemployment is low

Powell emphasizes inflation falling to target “over time” (soft-abandonment of target)

Powell is dismissive of the recent reacceleration in inflation and unfazed by it likely continuing

The neutral rate estimate has risen (albeit by a small amount)

What Does that Mean for the Future?

I generally think there is too much emphasis on the words of central bankers and not enough on the data. While the meeting as a whole was dovish, the Fed will be data-dependent in the future. The “dots” are flexible and if inflation continues to come in very hot with a strong labor market, the Fed won’t cut.

It is much better instead to focus on what will happen with the data given the macro pressures at play than to worry about the words of various central bankers or their predictions. That's cause the macro pressures will determine the data, and the data will determine policy.

I think the value of these meetings is in the ability to see the Fed’s underlying biases. They won’t cut in the face of hot inflation data. But, if the data is mostly ambiguous, we can see that they want to cut. If my tendency is to play it safe rather than risk inflaming inflation further and their tendency is to cut to prevent a weakening labor market, the Fed might act differently than I think they should. To trade well, you need to understand what the Fed will do, not what you think they should do.

In this view, the dot plot doesn’t really matter. It’s the biases of the Fed members today. But, to start a rate cutting cycle, Powell will need consensus and consensus won’t come until the data shows continued improvement in inflation. If the data doesn’t improve and inflation remains high, I doubt the Fed will get enough agreement to begin cutting.

Taylor Rule

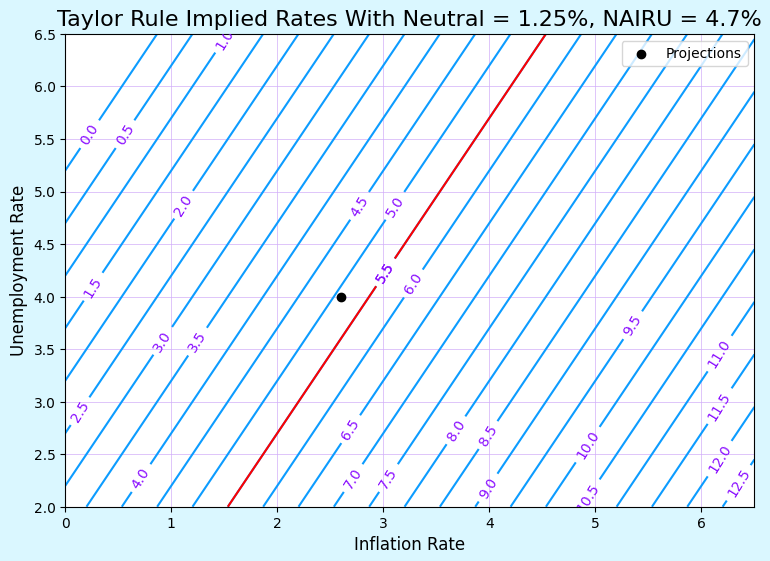

Let’s use the Fed’s own macro estimates to try to figure out the future path of rates. On Sunday, I showed how different estimates of the neutral rate and NAIRU can lead to vastly different Taylor Rule estimates. Today, I want to reverse the logic. The recent estimates of the neutral rate have risen (and my thesis is they will continue to rise to ~1.5%). NAIRU is commonly between 4.5 and 5%. I thus modeled the Taylor Rule upper bound with a 1.25% neutral rate and NAIRU = 4.7% and received an estimated 1-2 cuts from here by December (Figure 7). My view is that inflation will be stickier and the economy will be more resilient than they predict (and the neutral rate will be higher) which is why I believe they should not cut this year (as of right now). But, it doesn’t matter what I think they should do!

Figure 7: Using Fed’s Own Estimates, We Get an Estimated 1-2 Rate Cuts in 2024

Alternative View of the Fed

The alternative is that the Fed is data-dependent, but only when the data suits them! That is, they have such a strong desire to cut rates that they will be blinded by confirmation bias. High inflation can be dismissed, “they haven’t really changed the overall story”, while previously lower inflation prints can be lauded “we continue to make good progress on bringing inflation down.”

In this view, the Fed has found its desired solution (rate cuts) and is now solving for how to get there (more sensitivity to weak labor market data, ignoring higher inflation prints, subtly raising the inflation target/allowing a slower fall to target).

I disagree with her a ton, but I think Claudia Sahm is likely a good proxy for how the Fed thinks. Sahm has been repeatedly calling for rate cuts, ignoring the possibility of a higher neutral rate, and dismissive of higher inflation. Sahm’s deepest fear is likely the Fed’s deepest fear—creating an unnecessary recession. In this view, one should alter the Taylor Rule equation to place increasing emphasis on unemployment over inflation (which you can do by copying the code snipper I provided here). I look to Sahm to understand the data the Fed is sympathetic to.

While many believe Powell desperately wants to avoid being Arthur Burns, the Wednesday meeting flipped the script—maybe he doesn’t have the strength to be Paul Volcker and keep policy tight enough for long enough.

My View

I do think the Fed’s preference is to cut, but I am more sympathetic to the view that they are data-dependent. If the data continues coming in strong, the Fed will be forced to pivot from this minor pivot and will keep rates constant. The first cut is extremely important and I still doubt they will be reckless enough to actually cut before the inflation data improves.

Moreover, the longer the Fed signals that they will cut, the higher markets will rip and the worse the inflation data will be. As the market continually sees the Fed as preparing to ease, wealth effects will ripple into consumption, hurting the Fed’s case. I assumed the Fed had learned their lesson from October and December 2023 where they signaled easier policy ahead and were met with continually worse data. I believe inflation data will continue to come in hot and the Fed will be forced to retreat from their dovish stance.

For now, ignore the dot plot. Ignore the Fed’s projections for growth. Ignore the Fed’s inflation projections. Understand how the Fed operates: they have a bias to cut, they will prioritize the labor market over inflation, and they are uncomfortable with high nominal rates. This doesn’t mean they will cut in the face of worsening data, but it does mean they might be more dovish than I had previously expected.

What Does this Mean for Markets?

In the short run, the Fed has committed to being easy in the face of inflation data. Until they shift (which they will), the narrative is strongly in favor of equities and real assets. Financial conditions should remain loose and liquidity should be plentiful. I see the narrative as evolving in the following manner, but my beliefs may change as the narrative shifts.

Fed seems unserious about the inflation fight (“over time”, “haven’t changed the overall story”, etc.)

Equities, liquidity-driven assets, and real assets rally

Asset rally contributes to wealth effects, loosening financial conditions, higher consumption

Higher consumption continues to feed into higher inflation

Fed doesn’t follow through with their dovish posturing with inflation refusing to come down

Powell likely gives a more hawkish press conference, emphasizing “price stability” over “maximum employment”

Long bonds get sold off, equities begin to fall, etc.

Consumption slowly falls, inflation falls to near target, Fed can cut

We are currently in parts 1) and 2) of this narrative cycle and equities, real assets, and liquidity proxies should continue to rally in the meantime. As I believe inflation will continue to be above trend, my outlook is that the market-expected rate cuts will not materialize. Thus, I will only be tactically long risk and real assets in the short-run and will look to catch the narrative shift towards a hawkish Fed.

I would not touch long-term bonds at these levels. I believe the Fed has given equities and real assets an unbelievable opportunity by essentially being extremely long nominal growth, but longer-duration bonds inevitably will rally less than equities in the short run and will fall harder than equities as the market realizes the Fed made a mistake. Thus, the best way to trade the macro here is to be long nominal growth, real assets, and liquidity in the short run.

Extra

Here are some things I read/researched/did this week that I found interesting.

2023 Private Equity Fundamentals

I found this research piece by Verdad Advisers very cool. Verdad has been a longtime critic of private equity and has done insightful analysis on the potential of PE being in a bubble. In this piece, Dan Rasmussen analyzes the difference in revenue growth between public and private equity in 2023 before showing that higher interest rates have eroded FCF margins in private equity to ~0% (emphasis mine).

To outperform the market, a company generally needs to grow faster than the market, generate a higher free cash flow yield than the market, or see valuation multiples rise faster than the market. In 2023, PE-backed companies grew slower than the public market and generated significantly lower free cash flow. The lagging performance of buyouts relative to public markets looks like it might be more than just smoothing. It may reflect the weakening of the relative fundamentals.

Variance/VRP Research

On Sunday, I mentioned that the VRP was relatively low and, combined with low realized volatility, it could represent a good time to go long volatility. Well, I decided to quantitatively test if a low VRP was predictive of better long vol returns. There is a significant relationship between the VRP and the VIX and it seems predictive of future VIX levels. A low VRP is predictive of a higher VIX on a one-month time horizon (Figure 8). To prevent a Type I error, I didn’t fiddle with the duration at all, but I assume it probably works for two-month horizons as well and gradually loses its relationship.

Figure 8: Lower VRP is Bullish Vol

Fed Scraping

For fun, I scraped some of the Fed remarks and releases over the last three months and put together a word cloud to help visualize their words (Figure 9). It isn’t perfect, but I find it cool to look at.

Figure 9: Word Cloud of Fed Statements (2024)

End of My Time at LSE

I am basically done with my time at LSE after a wonderful year (I still have to turn in some papers/finals but classes are done). I greatly enjoyed the opportunity to live in London and loved my classes. Here are a few highlights from my year abroad.

Classes

I took extremely interesting classes and I learned a lot from them. Here are the top 4.

Advanced Macroeconomics

I had the opportunity to learn from extremely accomplished economists and learned how to perform better analysis, evaluate research at the forefront of macro, and communicate ideas clearly. I did research on creative destruction, the Phillips Curve, and inflation expectations along with some other topics.

Risk Management and Modeling

This class was excellent—I learned a lot about risk, modeling variance, and implementing forecasts to control risk. In my final project, I created a portfolio of assets, estimated the multivariate volatility of the portfolio using a combination of PCA and a GARCH(1,1) model, determined the distribution of the residuals, calculated VaR and ES, and sized positions.

Money and Finance from the Middle Ages to Modernity

I originally signed up for only the first semester of this course (Middle Ages to 1700s) but wound up really enjoying it and audited the course during the second semester. The course was an introduction to the creation of the modern financial system and analyzed money throughout history. I wrote a paper on the Great Bullion Famine and the Crisis of the Late Middle Ages.

Physics and Uncertainty: Quantum Jumps to Stock Market Crashes

This was probably the coolest course I’ve taken. The first half was on quantum mechanics while the second half related quantum to financial markets and theories. We explored physics-based approaches to modeling stock prices, options, and asset distributions. The course was a combination of philosophy, physics, and finance and melded the three fields together well.

Tennis

After having seemingly retired from tennis, I revived my career in an admittedly less intense setting. For most of our matches, the level was lower than the U.S. level, but I did get an opportunity to play in individual nationals for singles and doubles where the level was extremely high. As a team, we went undefeated and won our league and the cup title.

Traveling

I didn’t travel as much as I probably should have, but I still explored Europe. I visited Rome, Barcelona, Paris (2x), Brussels, and Amsterdam along with some trips to small towns in England (Figure 10). My perspective on the world and America has deepened—I now know what “water” is.

Figure 10: Windsor Great Park in the Fall

London

London is a cool city. I lived in LSE dorms near campus (Covent Garden) which is an amazing area. As someone passionate about markets, London is one of the few cities I’d be able to develop a great career. I went to some Premier League games, had good Indian food, and walked around Buckingham Palace a good amount (Figure 11). I’m happy I got a better sense of the city and, who knows, maybe I’ll wind up here again eventually.

Figure 11: Black Swan in St. James’s Park

This Substack!

I had some free time this semester as well and started this Substack. I’ve enjoyed writing this a lot and I have improved as a writer, coder, and market analyst (at least I think so!). I have written almost 60,000 words across 21 publications (including the original ones not posted on Substack). This has been a big time commitment, but one that has been incredibly fulfilling. Next week, I start work at a hedge fund and will be unable to continue these for the time being but, I will be back!

Thank You!

Thank you for reading until the end. I love writing these and enjoy talking to readers. I hope you all have a great weekend and please reach out if you want to discuss the Substack or talk about markets!

-Eli (ejn2@williams.edu)

this is phenomenal. im the #1 eli fan